Your step-by-step guide to filing crypto taxes in South Africa

Whether you sold, staked, mined or swapped, SARS wants to know. Here’s how to file it without the stress.

South Africans have been swapping, staking, and stacking coins for years. SARS noticed. If you bought, sold, earned, or spent crypto, it belongs on your return. This guide explains what to declare, how to calculate it, and where to submit it in eFiling, without using overly technical terms or scare tactics.

Before we delve into the numbers, let's secure the basics. If you are new to this space, refresh the essentials like KYC, fees, spreads, and setting up a wallet without leaving a digital trail so your records are clean from the start. It will save hours at tax time.

Here is the part many people skip: SARS doesn't treat crypto as a special snowflake. It applies normal tax rules. You must declare gains or losses, as well as income, if you earn through trading as a business, mining, staking, airdrops, or referral rewards. Failure to disclose can trigger penalties; maybe not right now, but it could catch up with you.

What counts as a taxable event

- Capital transactions: selling for rand, swapping coin-to-coin, or spending coins on goods or services. These are usually subject to Capital Gains Tax;

- Revenue transactions: frequent trading with an intent to profit, mining, staking rewards, yield, salaries or freelance income paid in crypto. These are taxed as income at your marginal rate.

Crypto is not “off the books”. SARS uses third-party data, exchange reports, and bank trails. Treat it like any other asset: record dates, values in rand, and why you transfered it. Missing records are a risk, not a flex.

Step 1: Get your records in order

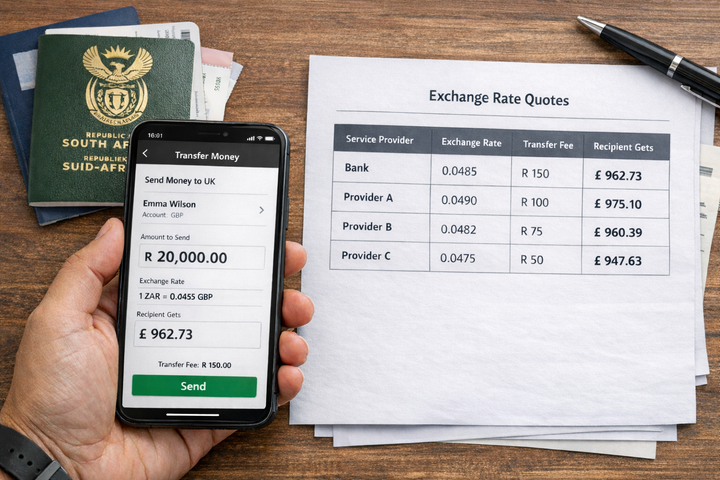

Compile a CSV or export from your exchange and wallet(s). You need the date, type, asset, quantity, rand value at the time, and fees of each transaction.

If you used multiple platforms, consolidate into one sheet. Exchanges and providers will increasingly share information under the OECD’s Crypto-Asset Reporting Framework, which South Africa has moved to adopt, so your numbers should match reality.

Step 2: Classify each transaction

Decide if an entry is capital or revenue in nature.

- Capital: long-term investing, occasional disposals, or spending crypto once in a while;

- Revenue: high-frequency trading, arbitrage, market-making, mining, staking payouts, or anything that looks like a business.

SARS looks at intent, frequency, and how you organise the activity. Grey areas exist, and you must be consistent and keep notes.

Step 3: Calculate gains and losses (capital side)

- For each disposal, compute proceeds in ZAR on the date of disposal. For coin-to-coin trades, use the fair market value in rand;

- Subtract base cost: what you paid plus allowable costs like trading fees;

- Net the year’s gains and losses;

- Apply the annual exclusion (currently R40,000 for individuals);

- Multiply the remainder by the inclusion rate for individuals: 40%. That figure is added to your taxable income and taxed at your marginal rate. The maximum effective CGT for individuals is about 18%.

Step 4: Work out income (revenue side)

Add up revenue items such as staking or mining, airdrops tied to services, or trading profits that look like business income. These amounts are fully taxable at your marginal rate. Keep invoices or platform statements where possible.

Most mistakes happen when people lump everything into one bucket. Treat investments like investments, and business-like activity like business income. The label follows the facts, not the other way round.

Step 5: VAT, if you are a vendor

The supply of a crypto asset itself is generally treated as a financial service and is exempt from VAT, yet VAT may apply to other services you provide, such as platform or advisory fees. If you are a VAT vendor, apply normal VAT rules to your taxable services, not to the crypto asset transfer.

Step 6: Fill it in on eFiling (ITR12)

- Capital gains: open the Capital Gains Tax section and capture disposals with dates, proceeds in rand, and base costs;

- Revenue items: declare as “other income” under the relevant section for business, freelancing, or investment income;

- Keep supporting schedules in case SARS requests them, and store CSVs/exports securely for five years. SARS’ ITR12 guide explains the sections and the assessment process.

Step 7: Provisional tax and timing

If you have significant non-salary income from crypto, you may need to register as a provisional taxpayer and submit estimates twice a year. This prevents a surprise bill in the annual assessment. SARS has been clear that crypto activity is part of its compliance focus.

Step 8: Common pitfalls to avoid

- Treating coin-to-coin swaps as not a sale;

- Ignoring fees in the base cost, which overstates gains;

- Mixing private investments with a side-hustle trading operation, then guessing at year-end. Keep wallets and records separate;

- Forgetting rand values on the day of each transaction. Use reliable historical price data and document your source.

Quick checklist

- Bank statements, exchange CSVs, and wallet exports;

- Each transaction is tagged as capital or revenue;

- CGT worksheet with proceeds, base costs, and R40,000 exclusion applied;

- Income items tallied at rand value on receipt;

- ITR12 updated, schedules saved, and supporting docs archived.

The goal is not to outsmart SARS. The goal is to file cleanly, pay what you owe, and move on. Good records beat good excuses every single time.

Comments ()