On-chain habits that reduce dumb losses

On-chain mistakes usually happen during normal use, not major failures. This mini-guide focuses on everyday habits that could drain your crypto wallet over time.

🔴 You might also like to read:

Crypto losses are not always “bad markets”. Many of them come from habits that would look reckless in any other part of your financial life: signing things without reading, approving access and forgetting about it, chasing hype, and treating every transaction like it has an undo button.

South Africans face additional friction as well: higher data costs, patchy connectivity, scam-heavy group chats, and the temptation to treat crypto like a shortcut because the rand keeps testing everyone’s patience. Getting the basics right matters. Self-custody vs exchange custody sits right at the centre of most avoidable losses.

This piece is a habits list, not a “tools list”. No app can save you from clicking the wrong link, and no influencer can reverse a transaction. A 30-minute wallet drill is the type of , practice that prevents expensive panic later.

Most dumb losses happen during normal behaviour, not during a hack. It normally involves things like a rushed swap, lazy signature, or a “quick” approval that stays open for months. Fix the habits, and the rest is less stressful.

On-chain security is not a vibe. It is mostly small, repeatable decisions that stop errors from turning into withdrawals you cannot reverse.

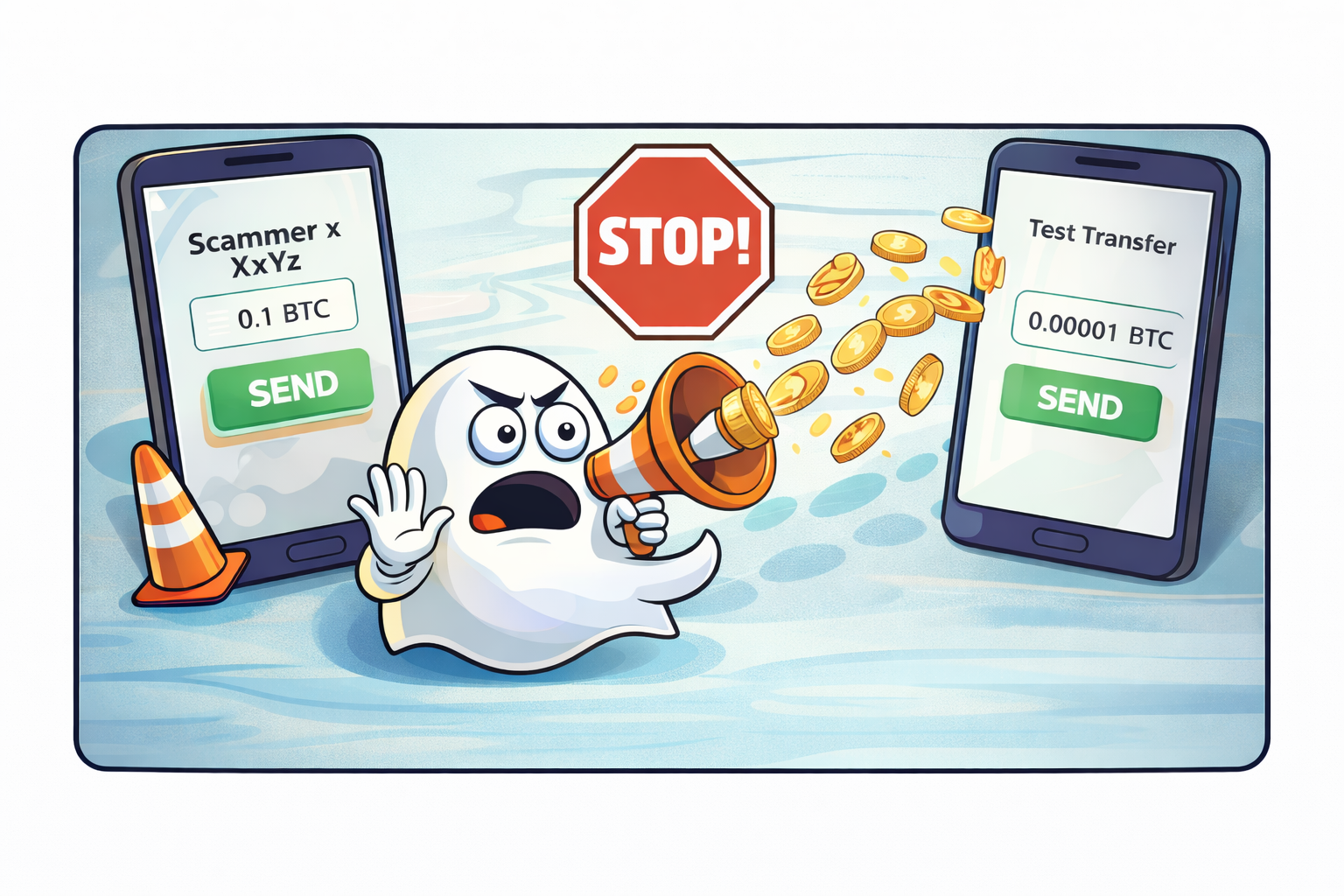

Habit 1: Treat every new address like a stranger and send a test first

On-chain transfers do not work like bank payments. If you send funds to the wrong address, there is no customer support desk that can pull it back. Transactions are designed to be irreversible once confirmed.

A simple habit reduces the worst version of this mistake: test before size.

- Copy the address, then check that the first four and last four characters match where you copied it from.

- Send the smallest amount the network allows without it being pointless.

- Wait for confirmation, then send the full amount.

If you do this every time you move funds to a new wallet, new exchange deposit address, or new contract, you stop “typo loss” and “clipboard hijack loss” in one go. Malware that swaps copied crypto addresses has existed for years, which makes double-checking characters less paranoid and more normal.

Habit 2: Approvals are not harmless; they are standing permissions

Token approvals are a hidden source of pain because they do not look like spending. Many DeFi actions require you to approve a smart contract to spend a token on your behalf. If the contract is malicious, compromised, or interacts with something malicious, an old approval can become a future loss.

Two habits help more than any “best wallet” debate:

- Approve exact amounts, not unlimited, unless you genuinely need unlimited for repeated use.

- Revoke approvals you no longer need, especially for tokens you hold long-term.

Unlimited approvals exist because they reduce friction for repeat swaps, but they also widen the blast radius if something goes wrong. Revoke checks take minutes and can save weeks of frustration.

This is the part most people skip because nothing looks wrong today. Old approvals are like leaving your house keys under the doormat because nobody robbed you last month.

Habit 3: Do not sign what you cannot explain in one sentence

Most wallet drains do not begin with “send”, but with “sign”. A signature can authorise actions that look harmless in a pop-up, especially when the request is presented as a game, an airdrop, a mint, a whitelist, or “verification”.

A solid habit is simple: if you cannot explain what the signature does, do not sign it.

Practical ways to enforce this without turning your life into a security audit:

- Use a “hot” wallet for experimenting and a separate wallet for long-term holdings.

- Refuse random DMs and “support” messages. Real projects do not need your seed phrase or private key.

- Treat links like food left open on a taxi seat. Nobody knows where it has been.

A scam does not need to be clever. It only needs you to be distracted. Most people do not lose crypto because they do not understand blockchain. They lose crypto because they treat signatures like terms and conditions, then wonder why the outcome is permanent.

Habit 4: Stop paying “panic premiums” for speed, hype, and ego

There are two ways people overpay on-chain: High fees during congested periods, and bad pricing during rushed swaps.

Fee spikes happen during big mints, meme coin frenzies, exchange dramas, and “everyone needs to move funds now” news cycles. If you chase the front of the queue, you pay for it. Ethereum’s own documentation explains how gas pricing relates to network demand.

Pricing losses happen on decentralised exchanges through slippage and poor route selection. Many DEX trades use automated market makers where price moves with pool liquidity, which means a large trade or a thin pool can give you a worse fill than the screen preview suggests.

Habits that cut this down:

- Decide a max fee before you click confirm. If the fee breaks that number, wait.

- Set slippage intentionally, not lazily. High slippage settings invite bad outcomes.

- Avoid thin pools unless you know why you are there.

- If the only way a trade “works” is by cranking slippage and paying peak fees, that trade is telling you something.

South Africans often do this late at night on mobile data, with lag, half-watching TikTok, and one eye on WhatsApp groups. That combo is how “small” mistakes become losses that sting.

If you can’t tolerate missing the trade, you are not trading; you are paying to relieve anxiety.

Habit 5: Use wallet separation like seatbelts, not like paranoia

A single wallet for everything is convenient until it is not. Wallet separation is not a “rich trader” habit.

It is a basic risk split:

- A spending or experimenting wallet (small balance, used for new dApps).

- A holding wallet (no random signatures, minimal approvals, funds mostly idle).

- An exchange wallet balance only when you need it (do not park long-term holdings on an exchange because it is easier).

The logic is the same as not carrying your full bank balance in cash. If something gets compromised, you cap the damage. This approach also protects you from your own mood. A hot wallet keeps the “try this new thing” impulse away from the bag you promised yourself you would hold for years.

A lot of self-custody education comes back to one point: nobody can reset your wallet if you lose keys, which makes setup discipline non-negotiable.

Habit 6: Keep receipts while you are calm, not when you are panicking

“On-chain habits” include admin habits, because messy records create dumb losses later through tax stress, missed withdrawals, or forgotten approvals.

Pick one method and stick to it:

- A simple spreadsheet with date, token, network, amount, transaction hash, and why you moved it.

- A portfolio tracker that pulls transactions from your wallet and lets you tag them.

- A monthly “audit hour” where you check approvals, balances, and what you have connected to what.

South Africa’s tax treatment of crypto depends on your facts and behaviour, which makes clean records worth the effort even if you hate paperwork. SARS has made it clear that crypto transactions are taxable and that taxpayers must declare relevant gains or income.

Nobody avoids every loss. The point is to avoid the dumb ones: the preventable losses due to speed, distraction, and casual permissions. On-chain gives you control. Control comes with responsibility. Treat that as a feature, not as a burden.

🔴 Have you read these articles yet? Each one is a quick read, and we think you’ll enjoy it.

👉 The value of a quiet hour

👉 Why a simple pantry setup makes life easier at every age

🔴👉 Visit our other publications:

The Travel Thread | Where lekker meets latitude.

Karoo Times | Real Karoo. Real People. Real Business.

De Kaap Echo | Your community. Your story.

Comments ()