The 15-minute monthly money audit that could save you hundreds

Fifteen minutes, one coffee, and a banking app; that’s all it takes to start keeping your money on your side.

Every month, the rand does its little dance, and you swear you’ll get on top of your spending. Then debit orders go off, Woolies specials whisper your name, and before payday, your bank balance looks like a bad joke.

The fix isn’t another lecture about “cutting coffee” but a 15-minute monthly audit that finds the money leaks and plugs them before they sink your budget.

The ground rules

You don't need colour-coded spreadsheet marathons or ten-step systems. All you need is your banking app, a calculator, and brutal honesty. This works because it’s quick enough to repeat every month, so you can catch problems before they become habits.

In South Africa, inflation has stubbornly hovered above the Reserve Bank’s midpoint target, with food and transport costs leading the climb, according to Stats SA.

Add in the hidden price tags of load-shedding, like generators, inverters, or simply more takeaways when the stove’s dead, and the cost creep is real. That’s why catching leaks early is important.

Step 1: Scan your last month’s transactions

Open your banking app and scroll through the last 30 days. Flag anything you don’t remember signing up for, didn’t plan to spend, or haven’t used in weeks.

The usual suspects?

- Streaming services you haven’t watched since the last season drop.

- Gym contracts you swore you’d “get back into”.

- Cloud storage you’ve maxed out once, then ignored.

If you find something useless, cancel it now. South Africa’s Consumer Protection Act gives you the right to cancel most fixed-term contracts with 20 business days’ notice.

Step 2: Hunt the lazy leaks

These are the “I’ll deal with it later” spends that drain your account in small, regular increments. Uber rides instead of public transport or carpooling. Daily takeaways. “Quick” Woolies runs for bread that somehow costs R350.

Do the maths: three R120 takeaway meals a week adds up to R1 440 a month, which is enough to pay for a broadband upgrade, an extra savings boost, or that inverter you’ve been meaning to buy.

Step 3: Compare to your budget goals

If you don’t have a budget, that’s your first job. Use a South African-friendly tool like Vault22 or even a simple Google Sheet. Set realistic category limits for essentials, nice-to-haves, and savings.

Now, line up last month’s spending with those targets. Over by R500 on transport? That’s a conversation with yourself about Uber vs petrol vs carpool. Under on entertainment? Great. Put that surplus in savings before it disappears.

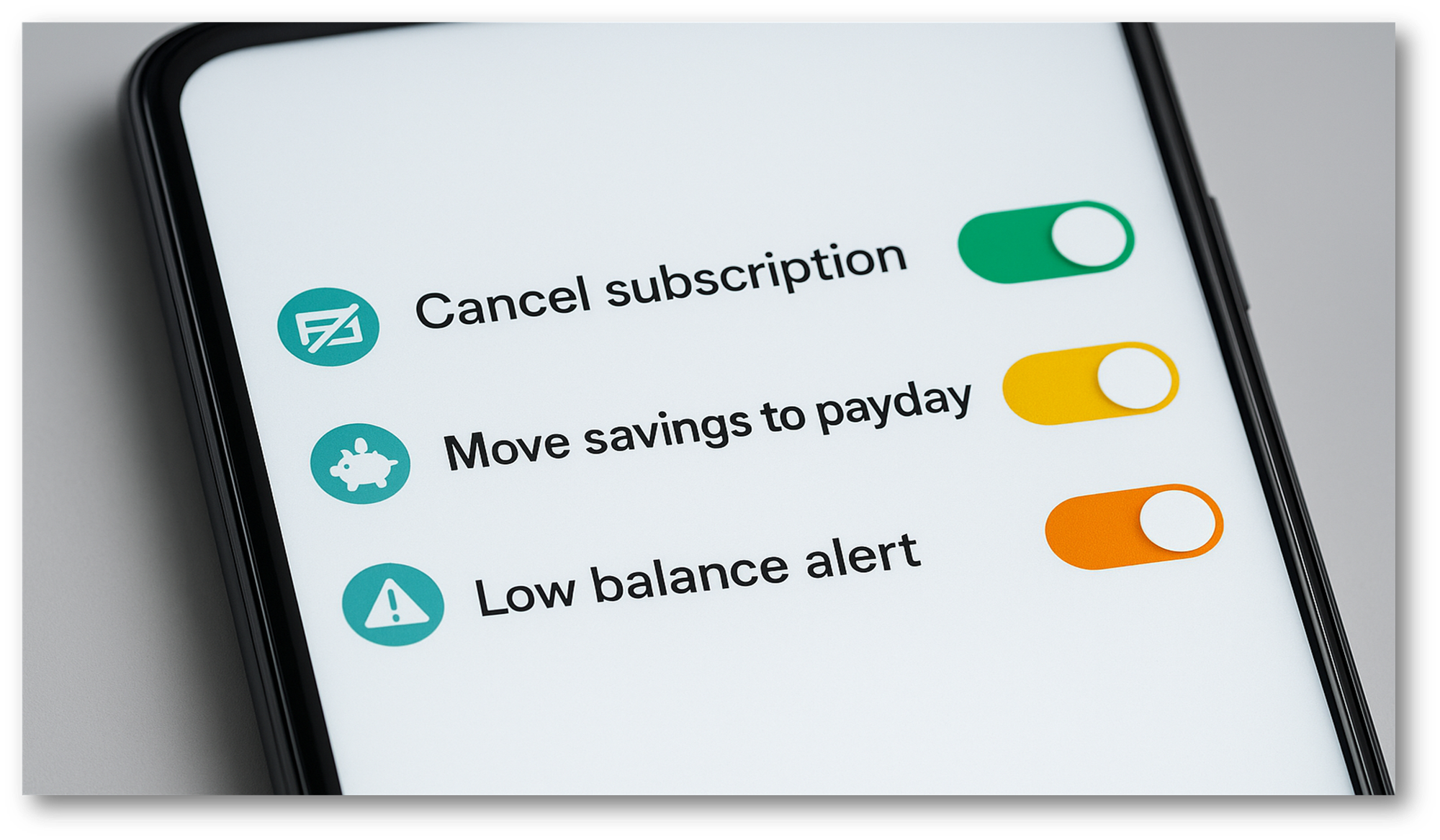

Step 4: Set auto-corrections

This is where you ensure changes are made:

- Cancel one deadweight subscription immediately;

- Shift your savings transfer to payday so it’s untouchable;

- Set low-balance alerts on your banking app.

A small tweak you repeat every month compounds into real money over time.

Fifteen minutes once a month is the difference between ending on salticrax and actually making progress. The rand’s mood swings aren’t in your control, but how you track and adjust your spending is. Treat your money like a leaky roof; ignore it, and you’ll pay more later.

Comments ()