Budgeting apps that work in SA without manual currency tweaks

You shouldn’t need a settings deep-dive to tell your app you live in South Africa. These ones already know.

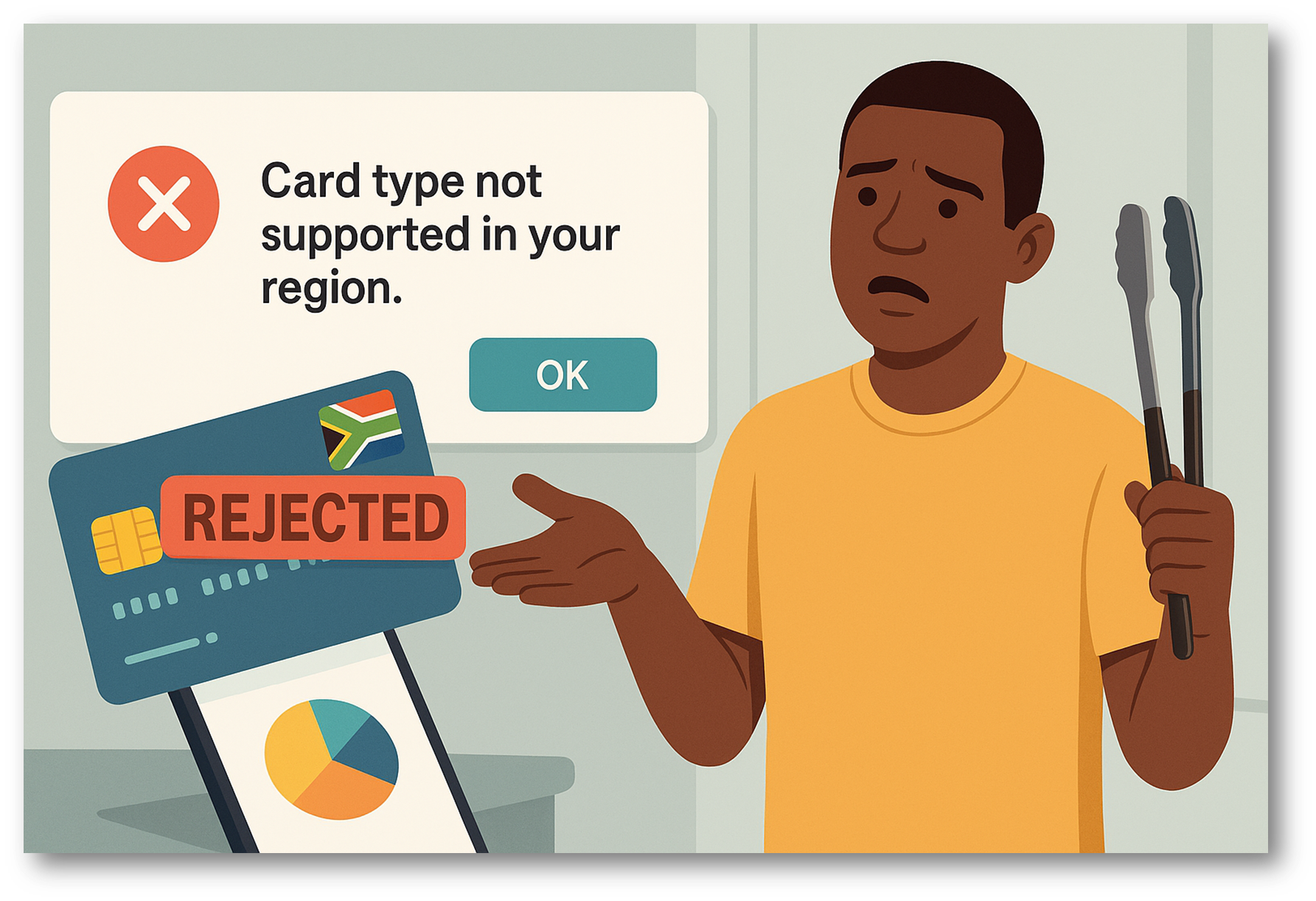

If your budgeting app still shows dollars, you’re not budgeting but babysitting a calculator. South African users deserve tools that speak rands, show real transaction data, and don’t ask you to “manually adjust currency settings” like it's still 2013.

Most global apps don’t get it. They think South Africa is one of those dropdown options no one clicks on. The ones that do work? They either build for this market or integrate with banks that live here. Here’s what that looks like.

Bank apps that already get it

You already bank in rand. Some local apps treat that like a feature.

FNB nav» Money

Available on the FNB app. It tracks your spend, shows a net-worth dashboard, categorises everything, and flags when you’re blowing through your budget. It works in Rands because that’s what your account uses. There are already over five million users, according to FNB in March 2025.

Nedbank MoneyTracker

Built into Nedbank Online Banking and the app. You can group your income and expenses, track budgets, and even set savings goals. Everything is in ZAR without setup headaches.

Standard Bank Budget Manager

Available on the Standard Bank app. It builds your budget based on how you actually spend, so you don’t have to guess what “Transport & Travel” means. Transactions show in rand, as they should.

Capitec app

Capitec’s app gives you automatic categorisation and a live view of your spending. It’s basic, but if you’re already a Capitec user, it shouldn't be difficult to navigate.

Discovery Bank Vitality Money

Discovery Bank’s financial analyser sorts your transactions into over 160 categories. It shows how you spend, where you’re off-track, and how to nudge your score upwards. It's fully ZAR-native, built to sync with Discovery’s broader Vitality rewards system.

The best budgeting app might already be on your phone.

If you use a major South African bank, chances are your banking app already shows you where your money’s going. No currency setup, dodgy permissions, or third-party imports. The tools are often there. You’re just not using them.

Apps that go beyond one bank

If you have accounts in more than one place, or you want to see the full picture without opening five apps, these tools are worth looking at.

Vault22 (formerly 22seven)

This is the one most South Africans know. It connects to over 120 local banks and institutions, lets you track spending, set budgets, and get alerts. While it's now owned by Root, it still works in rand.

Buxfer

This one’s international, but supports South African banks and local currency. You can track accounts, set budgets, and customise categories. It’s clean, but be ready for a slightly more technical UI. Currency shows in ZAR if you set it as your default, and bank feeds work with the big players.

YNAB (You Need A Budget)

This is the darling of Reddit finance nerds. You can budget in ZAR. What you can’t do easily is connect to your South African bank. You’ll be uploading CSVs or punching in numbers manually. If you’re after total control and don’t mind the admin, it works.

Most international apps assume your money lives in a Chase or HSBC account.

South Africans still have to fight for visibility, even when it comes to tracking debit orders. Look for apps that either connect to your bank or let you set ZAR as the base currency, without breaking the interface.

Budgeting in South Africa shouldn’t feel like a hack. Whether you’re using the built-in tools from your bank, a local aggregator like Vault22, or a global option with ZAR support, the rule is simple: if you have to trick the app into understanding your money, it’s not built for you.

Start with what you already have. Move up if you need more control. Either way, the goal is the same: track your spending in the currency you already use.

Comments ()